Gift Planning

Planned Giving

Find out what types of assets make the best planned gifts. Learn about gifts of cash, securities and property.

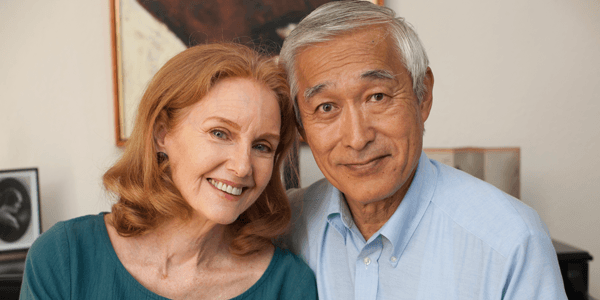

Bob and Mary Are Giving Smarter and Achieving Their Dreams...Find Out How You Can Too!

Bob and Mary first met at Two-Bit Flicks, a 25-cent movie night held on Fridays in Brighton Lecture Hall. When the spring formal hosted by the women's dorm came around, Mary asked Bob to go with her. It was their first "official" date.

The rest, as the saying goes, is history. Or in Bob and Mary's case, it is natural history. That's because Emporia State also introduced them to a lifelong passion for the natural sciences.

Bob and Mary feel Emporia State was the catalyst for the life they've built together. Mary became a science educator for 6th, 7th, 8th and 9th grade students. Bob founded and served as director of the Great Plains Nature Center and became a renowned nature photographer.

Now they want others to have the same opportunity they did. They want to help students come to ESU and discover a passion they can follow for the rest of their lives.

Bob and Mary found a simple and easy way to achieve this dream. When they set up their trust, they named Emporia State as a beneficiary.

What's your dream?

Learn how easy it is to make your dream a reality by naming Emporia State University in your will or trust. Contact Angela Fullen, Director of Planned Giving at the Emporia State University Foundation. She can answer your questions or help you get started. If you have already named Emporia State in your will or trust, let us know. We will make sure your gift does everything you want it to do.

"I would encourage anyone, if they are thinking about doing something like this, to contact the Foundation. For us, it has been a great experience." - Mary Butel

Getting Started is Easy

Not sure how to take the first step? We've got just the thing you need. Download your free Will and Estate Planning Guide. This guide is an easy way to get started on, or update, your estate plan. It will help you explore your options at your own pace. It's free, easy and yours to keep.

Download your copy today or contact Angela Fullen to request a printed copy.

Angela Fullen

Director of Planned Giving

Telephone: 620-341-6465

[email protected]

Testamentary Charitable Remainder Unitrust: Have Your Cake and Eat it Too!

Is a testamentary charitable remainder unitrust right for you?

Retirement accounts, such as an IRA or 401(k), make great gifts to fund a testamentary charitable remainder unitrust. The trust will provide income to family while also benefiting charity. If you have questions about this gift option, please give us a call.

*Please note: The names and image above are representative of a typical donor and may or may not be an actual donor to our organization. Since your benefits may be different, you may want to click here to view an example of your benefits.